SBI Bank Mudra Loan is a government-backed loan scheme offered by the State Bank of India (SBI) to provide financial assistance to small and micro-enterprises (SMEs) in India. The scheme is part of the Pradhan Mantri Mudra Yojana (PMMY), a flagship initiative of the Government of India aimed at promoting entrepreneurship and providing credit to the unorganized sector.

Understanding the SBI Mudra Loan

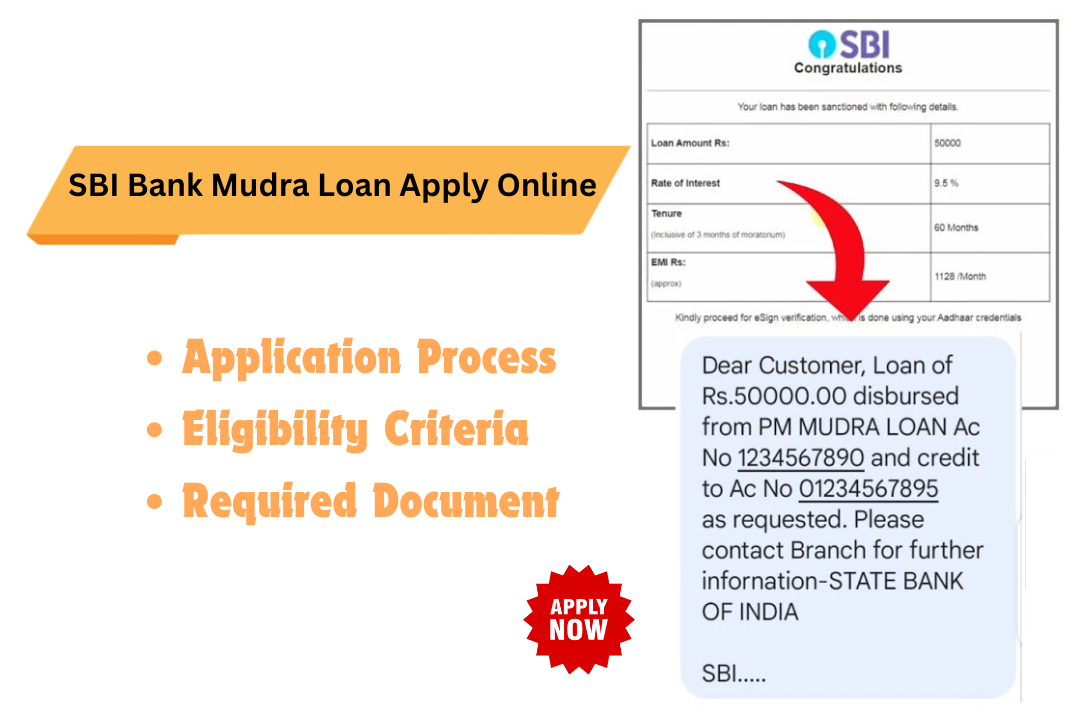

The SBI Mudra Loan is designed to cater to the specific needs of small businesses. It offers flexible repayment terms and competitive interest rates, making it an attractive option for entrepreneurs. The loan can be used for various purposes, including working capital, purchase of machinery, equipment, or raw materials.

Key Features of SBI Mudra Loan:

- Government-backed: The loan is backed by the Government of India, providing a sense of security to borrowers.

- Flexible repayment options: Borrowers can choose from a variety of repayment schedules to suit their cash flow.

- Competitive interest rates: SBI offers competitive interest rates on Mudra loans.

- Minimal documentation: The loan application process is relatively simple, requiring minimal documentation.

- No collateral security: In many cases, the loan can be obtained without collateral security.

Eligibility Criteria for SBI Bank Mudra Loan

To be eligible for an SBI Mudra Loan, a business must meet the following criteria:

- It should be a micro or small enterprise as per the criteria defined by the Government of India.

- The business should have been in operation for at least one year.

- The business should not be in default with any other financial institution.

-

Age: 18-65 years

-

Business: Non-corporate, non-farm sector income-generating activities

-

Loan Amount: Up to ₹10 lakh

-

Repayment Period: Up to 5 years

SBI Mudra Loan Categories

The SBI Mudra Loan is categorized into three schemes based on the loan amount:

- Shishu: Loans up to ₹50,000

- Kishor: Loans between ₹50,000 and ₹5 lakh

- Tarun: Loans above ₹5 lakh

How to Apply for SBI Mudra Loan Online

Applying for an SBI Mudra Loan online is a convenient and efficient process. Here are the steps involved:

- Visit the SBI website: Go to the official website of State Bank of India. ( www.sbi.co.in )

- Locate the Mudra Loan section: Look for the section related to Mudra loans.

- Fill out the application form: Complete the online application form, providing all the necessary details about your business and financial information.

- Submit required documents: Upload the required documents, such as proof of identity, address, income, and business registration.

- Submit the application: Once you have completed all the necessary steps, submit the application.

- Await approval: After submitting the application, you will need to wait for SBI to review and approve your loan request.

Documents Required for SBI Mudra Loan

The specific documents required for an SBI Mudra Loan may vary depending on the loan amount and the nature of your business. However, some common documents that may be required include:

- Proof of identity (Aadhaar card, PAN card, passport, etc.)

- Proof of address (Aadhaar card, utility bills, etc.)

- Proof of business registration (GST registration, shop establishment certificate, etc.)

- Business plan

- Financial statements (profit and loss account, balance sheet)

- Bank statements

Interest Rate and Fees

Benefits of SBI Mudra Loan for Small Businesses

SBI Mudra Loan offers several benefits to small businesses, including:

- Financial support: The loan provides much-needed financial assistance to small businesses, enabling them to expand their operations and increase their revenue.

- Job creation: By supporting small businesses, the SBI Mudra Loan can help create jobs and contribute to the overall economic development of the country.

- Reduced dependence on informal lenders: The loan can help small businesses reduce their reliance on informal lenders, who often charge exorbitant interest rates.

- Improved creditworthiness: Repaying the SBI Mudra Loan on time can help improve the creditworthiness of small businesses, making it easier for them to access future loans.

Conclusion

The SBI Mudra Loan is a valuable financial tool for small businesses in India. By providing affordable credit and flexible repayment options, the scheme can help entrepreneurs realize their dreams and contribute to the growth of the economy. If you are a small business owner looking for financial assistance, consider applying for an SBI Mudra Loan.

[Disclaimer: This article is for informational purposes only and should not be construed as investment advice in any way. financestock.in advises its readers and viewers to consult their financial advisors before taking any money-related decisions. subscribe for the latest updates llike a Mukesh Ambani Net Worth ]