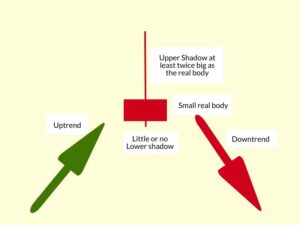

A shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly, but then closes near the open price.

The distance between the highest price of the day and the opening price should be more than twice as large as the shooting star’s body.

Formation of Shooting Star

Here is the formation of shooting star candlestick pattern:

What does Shooting Star tells you?

Shooting stars signals a potential downside reversal and is most effective when it forms after 2-3 consecutive rising candles having higher highs.

A shooting star opens and rises strongly during the trading session, showing the same buying pressure that is seen over the last trading sessions.

At the end of the trading session, the sellers push the price down near the open.

Learn to trade better with candlesticks in just 2 hours by Market Experts

This shows that the buyers have lost control by the end of the day, and the sellers have taken over.

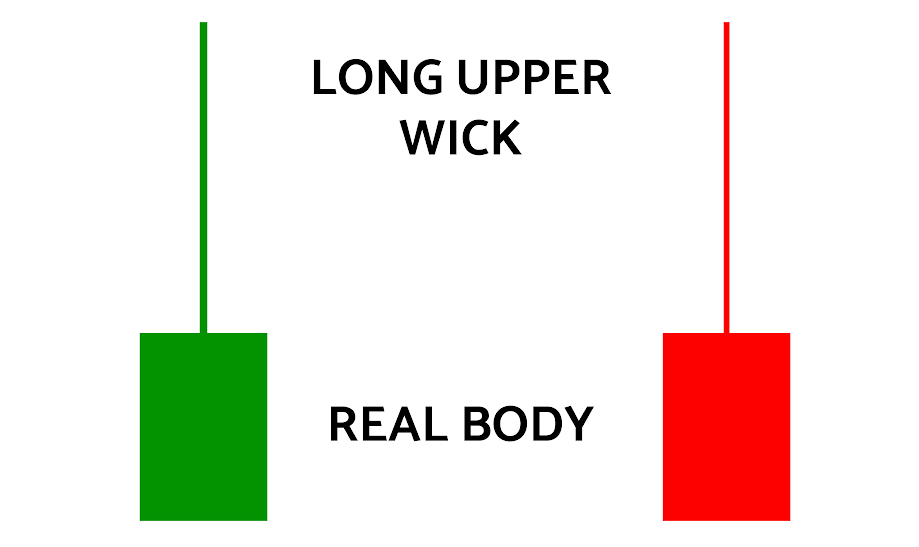

The long upper shadow indicates that the buyers are losing position as the price drops back to the open.

The candle after the shooting star gaps down and then moves lower on heavy volume.

This candle helps in confirming the price reversal and indicates that the price will continue to fall.

Trading Example:

Before trading with the shooting star, one should remember the following points:

- Trade Entry: Before you enter a shooting star trade, you should confirm that the prior trend is an active bullish trend.

- Stop Loss: You should always try to use a stop-loss order when trading the shooting star candle pattern.

- Taking Profits: The price target for this trade should be equal to the size of the shooting star pattern.

Below is an example of the shooting star candlestick pattern in the daily chart of Nifty. We can see how the shooting star is formed after a strong uptrend and signals a bearish reversal.

Limitations of Shooting Star:

One should not only rely on a candle pattern like in a shooting star for making trading decisions.

This is why confirmation is required, one can confirm by the next day candle or other technical analysis indicators.

One should also use stop losses when using candlesticks to control the losses.

A candlestick pattern is more significant when it occurs near an important level signaled by other forms of technical analysis.

Learn – What is Bearish Kicker Candlestick Pattern?

-

Inverse Shooting Star: A bullish reversal pattern that appears at the end of a downtrend

Key Takeaways:

- A shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly, but then closes near the open price.

- A shooting star is a bearish candlestick pattern having a long upper shadow and no lower shadow at all.

- There is a difference between a shooting star and an inverted hammer.

- One should not only rely on a candle pattern like in a shooting star for making trading decisions.

Live Example:

FOLLOW WA NOW WhatsApp channel!

[Disclaimer: This article is for informational purposes only and should not be construed as investment advice in any way. financestock.in advises its readers and viewers to consult their financial advisors before taking any money-related decisions.]